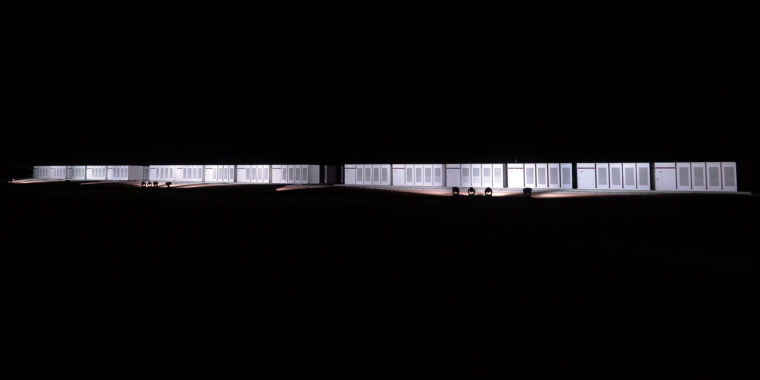

In the first half of 2018, energy sales from Tesla’s 100MW/129MWh battery installation at the Hornsdale Wind Farm in South Australia brought in €8.1 million in the first half of 2018.

€6.7 million ($7.8 million) of that revenue came from frequency control services. Another portion of the revenue was generated through a 10-year contract that Neoen has with Australian grid managers to purchase AUD $4 million (€1.4 million, USD $2.9 million) worth of electricity per year. The contractual revenue is before interest, tax, depreciation, and amortization, however, so actual numbers may be higher or lower.

The battery itself cost €56 million ($66 million), documents say.

The new information is courtesy of French renewable energy company Neoen, which released a report (PDF) detailing its business in advance of an initial public offering (IPO). The numbers give some depth to an earlier report published by the Australian Energy Market Operator (AEMO), which praised the battery in April for its ability to quickly provide so-called Frequency Control Ancillary Services (FCAS).

Rather than drawing from the battery system to supply normal energy demand, the battery is often used to manage anomalies on the grid. A battery can maintain the grid’s even frequency if, say, a generator goes offline or electricity demand spikes suddenly. Those “ancillary services” are usually served by gas-fired peaker plants on a traditional grid—gas turbines will quickly start up or temporarily increase production to make up for the electricity slack on the grid. Because batteries are chemical and generators are mechanical, batteries can send electricity to the grid immediately without needing to get a generator spinning at the right speed, so they’re much faster at responding to grid needs than gas-fired generators.

Cool contracts

Renew Economy notes that Tesla’s battery at the Hornsdale Wind Farm has flexibility built into its various contracts. Specifically, 70MW of the battery’s 100MW capacity is contracted to the Australian government. The other 30MW can be used to arbitrage prices, delivering electricity when demand is especially high or supply is especially constrained.

Neoen has one other battery installation augmenting a solar power plant at the moment, though it’s an off-grid battery system. This system serves the DeGrussa copper mine, and it helps offset the use of five million liters of diesel a year.

The company hopes its success with the Tesla battery will be repeated in a new, smaller on-grid installation, with batteries once again provided by Tesla. That battery will be 20MW/34MWh, and it will be connected to the Bulgana Wind Farm in the Australian state of Victoria. Renew Economy notes that Neoen has a deal with the Victorian government “to take 90 percent of the output from the 190MW Bulgana Wind Farm and the 20MW/34MWh Tesla battery that will accompany it” and sell it for “between $55/MWh and $65/MWh.”

Neoen’s report states that it has other storage sites in development, in France, Australia, and El Salvador. Neoen noted in its report (translated from French) that it “intends to continue to integrate storage in its projects to ensure the stability of its photovoltaic and wind projects and to increase their competitiveness and profitability. In addition, the Group has already begun to develop storage to generate new sources of revenue, including the provision of stabilization to Australian power grids.”

Be the first to comment